NFTs—Decoding The Hype

I first came across the use of NFTs in gaming while watching this a16z video in May 2020. Until then I had just heard of NFTs in the context of CryptoKitties, but that video piqued my curiosity to dive deeper. After going down the rabbit hole, I was excited to find that NFTs could be used even outside of gaming to empower content creators. Its promise to shift the balance of power from gatekeeping monopoloies and middlemen back to individuals and small-businesses resonated with me. NFTs alter the notion of 'ownership' that is so core to finance and thereby creates space for new business models. Programmable ownership democratizes access to 'deal-making' that were earlier feasible only for celebrities. For example, creators could now partially sell their IP rights, have a claim on their IP's future cashflows, securtize the cashflow from IPs, etc. Having worked in structured finance and payments a bit, this smelled of an opportunity.

You see, time and again, industries and products go through these cycles of bundling and unbundling. The nimbler company that identifies the trend first and creates a differentiated product captures a lot of value from the resulting blue ocean. This attracts competition and then overtime the differentiation fades away and alongside its value capture. And, the cycle repeats! Something similar was happening with payments. On the one hand, payments industry is a lot like that red ocean- most businesses scramble for the 3% cut. On the other hand, web2 monopolies (App Store, Google Store, etc.) have a 30% take-rate. Distributors and publishers command power over the creators across all forms of media and entertainment, resulting in creators getting a raw deal for their IP. By bundling payments with ownership of IP itself, NFTs promised to alter this equation in favor of creators. I felt this theory was further validated when Square bought TIDAL about 6 months later in Mar 2021.

Musicians were one of the worst hit artists by the pandemic as bulk of their revenues come through tours. The millions of YouTube views and Spotify streams dont translate a lot into $$. In this context, TIDAL presented a solid headstart to SQUARE to create a blue ocean by bundling music with payments using blockchain technology. It did not come as a surprise, therefore, when Square, Inc renamed itself to Block in Dec 2021, given its new blockchain-related endeavors.

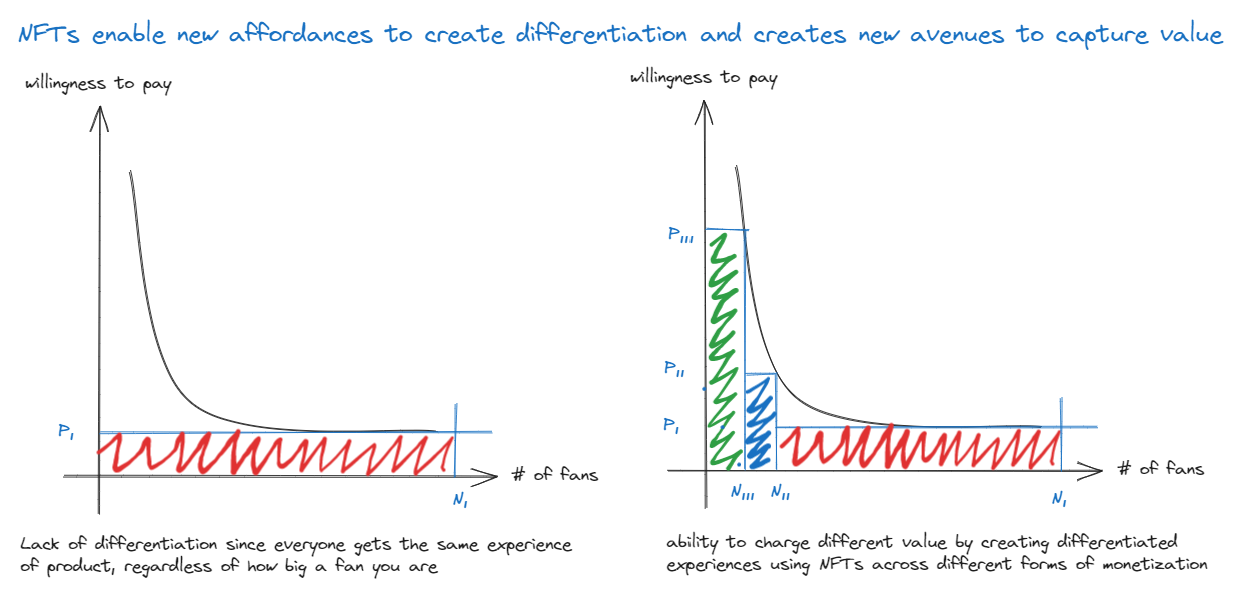

NFTs promised a fairer deal to creators- and that was one of the reasons why major celebrities started endorsing the technology right, left and centre. Not only were the take-rates much lower in web3 marketplaces, creators could enlarge their pie by unlocking untapped spending potential. This was done effectively by early-adopters like 3LAU with adept use of auctions.

You see, time and again, industries and products go through these cycles of bundling and unbundling. The nimbler company that identifies the trend first and creates a differentiated product captures a lot of value from the resulting blue ocean. This attracts competition and then overtime the differentiation fades away and alongside its value capture. And, the cycle repeats! Something similar was happening with payments. On the one hand, payments industry is a lot like that red ocean- most businesses scramble for the 3% cut. On the other hand, web2 monopolies (App Store, Google Store, etc.) have a 30% take-rate. Distributors and publishers command power over the creators across all forms of media and entertainment, resulting in creators getting a raw deal for their IP. By bundling payments with ownership of IP itself, NFTs promised to alter this equation in favor of creators. I felt this theory was further validated when Square bought TIDAL about 6 months later in Mar 2021.

Square is acquiring a majority ownership stake in TIDAL through a new joint venture, with the original artists becoming the second largest group of shareholders, and JAY-Z joining the Square board. Why would a music streaming company and a financial services company join forces?!

— jack (@jack) March 4, 2021

Musicians were one of the worst hit artists by the pandemic as bulk of their revenues come through tours. The millions of YouTube views and Spotify streams dont translate a lot into $$. In this context, TIDAL presented a solid headstart to SQUARE to create a blue ocean by bundling music with payments using blockchain technology. It did not come as a surprise, therefore, when Square, Inc renamed itself to Block in Dec 2021, given its new blockchain-related endeavors.

NFTs promised a fairer deal to creators- and that was one of the reasons why major celebrities started endorsing the technology right, left and centre. Not only were the take-rates much lower in web3 marketplaces, creators could enlarge their pie by unlocking untapped spending potential. This was done effectively by early-adopters like 3LAU with adept use of auctions.

Now you may wonder why were people willing to spend $11.7M on 33 NFTs. One has to acknowledge the FOMO and speculation in March 2021 due to the pandemic, but that doesnt explain the entire story. Auctions just help capture value, but actual value comes from something else. What is that something else? That something else is the community, and the role an NFT plays in that community. Anything has value because people ascribe value to it. Other people ascribe value to that thing because that thing serves some purpose in the shared story that forms the basis of a community's shared experience.

Consider this Disclosure NFT that got sold for $140,000. This face doesnt mean much to someone who is not fan of the music duo- Disclosure. But on the other hand, this symbolic face is the primary symbol or meme that Disclosure fans use to signal that they belong to a particular community. Sometimes these symbols take more functional roles apart from having just symbolic values. For example, the BTS Army Bomb serves an important purpose in BTS concerts apart from just signalling that one is a BTS fan. Thus when evaluating an NFT(s) one needs to consider both the community and the role played that NFT(s) plays in its community. We can break down this relationship further as below- the 1st part relates to value potential while the 2nd part is related to value capture.

|

|

- Community Potential = f(close-knit nature of community, size, combined spend capacity)

- Role played by NFT in the community = f(utility, rarity)

When you look at NFTs from this perspective, you can start to consider the possibility that there maybe something more to this technology than just speculation. NFTs enable creators to get support from their community in innovative ways that weren't feasible before. I think that's what makes this technology interesting. It promises change- a change that aims to grow the size of the pie as well as tip the balance of power in favor of individuals. Wasn't this the change we all wanted?