Vertical Software in FinTech

I recently reflected on my learnings from working at an early-stage SaaS startup here. In that post I synthesized different data points on why AI-first startups have a better shot at creating venture outcomes by aiming for niches where they can create vertical software. In this post I expand on that idea further by studying one particular industry that has recently seen the rise of vertical software providers (Brex, Ramp, etc.). The goal is to gather insights for early-stage founders building at the intersection of AI and SaaS.

We’ll start by providing some context around the ‘spend management’ industry, followed by mapping the industry landscape. Then, we’ll identify key trends shaping competitive forces and explore how these trends could influence strategies for vertically integrated solution providers. Finally, we’ll conclude with key takeaways for early-stage founders.

Putting Pieces Together

The inspiration for this post dates back to November 2022. I was working at Finicast, a planning-related startup, when BILL acquired Finmark, another planning-focused startup geared toward SMBs. This move made sense to me, considering BILL’s prior acquisitions of Divvy and Invoice2Go. However, I initially saw this as an isolated event, aligning with BILL’s SMB focus and its transaction-revenue-driven model.

Then, in December 2022, Thoma Bravo announced to take Coupa private. Coupa, a SaaS platform designed for large enterprises, stood in stark contrast to BILL’s SMB-oriented portfolio. This development prompted me to step back and question whether something larger was at play. I recall highlighting this to our startup’s CEO and CTO at the time because just 9 months earlier, in March 2022, Thoma Bravo had announced to take Anaplan private - the largest incumbent in the category that we were operating in.

Were these two acquisitions just coincidences, or was this a white-lint-on-a-black-dress moment and there was something more to this? I wondered if there were synergies between planning and spend management businesses. Since then, I’ve closely monitored this space, and recent developments, as shared below, suggest possible secular trends shaping the industry. I therefore felt it would be useful to study this industry more closely as it undergoes this transition.

- TripActions rebrands to Navan after couple of acquisitions and get readies for an IPO, Feb 2023

- Brex launches integrated travel solution, Mar 2023

- Travelport investors commit $570 million in new equity financing, Dec 2023

- Ramp acquires Venue and enters into procurement space, Jan 2024

- AMEX GBT to acquire CWT, Mar 2024

- Madrona Venture Group announces its plans to transform corporate travel, Apr 2024

- Ramp launches travel offering, Jun 2024

Spend Management - The Industry Structure

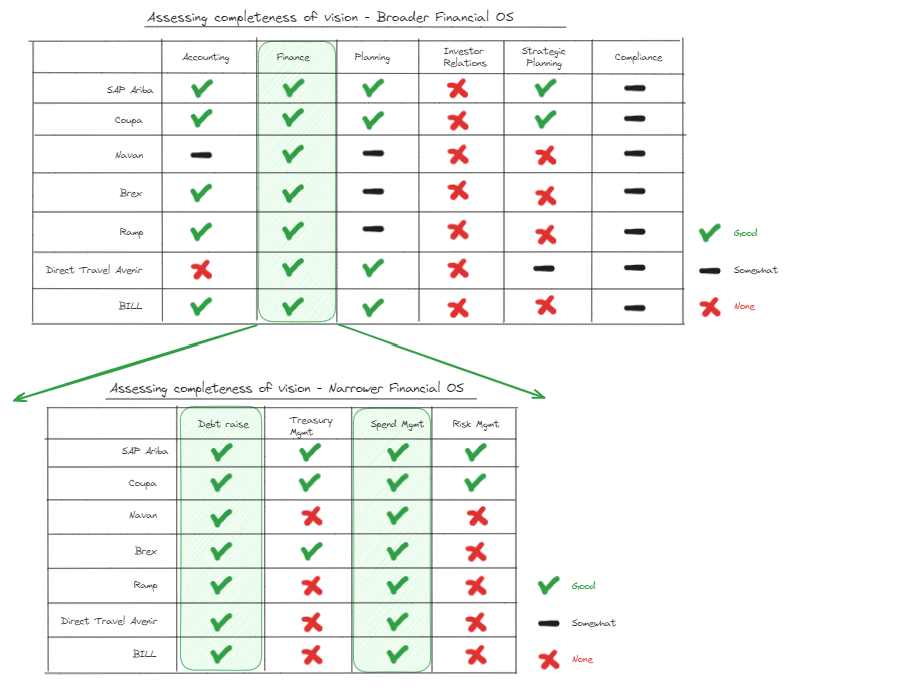

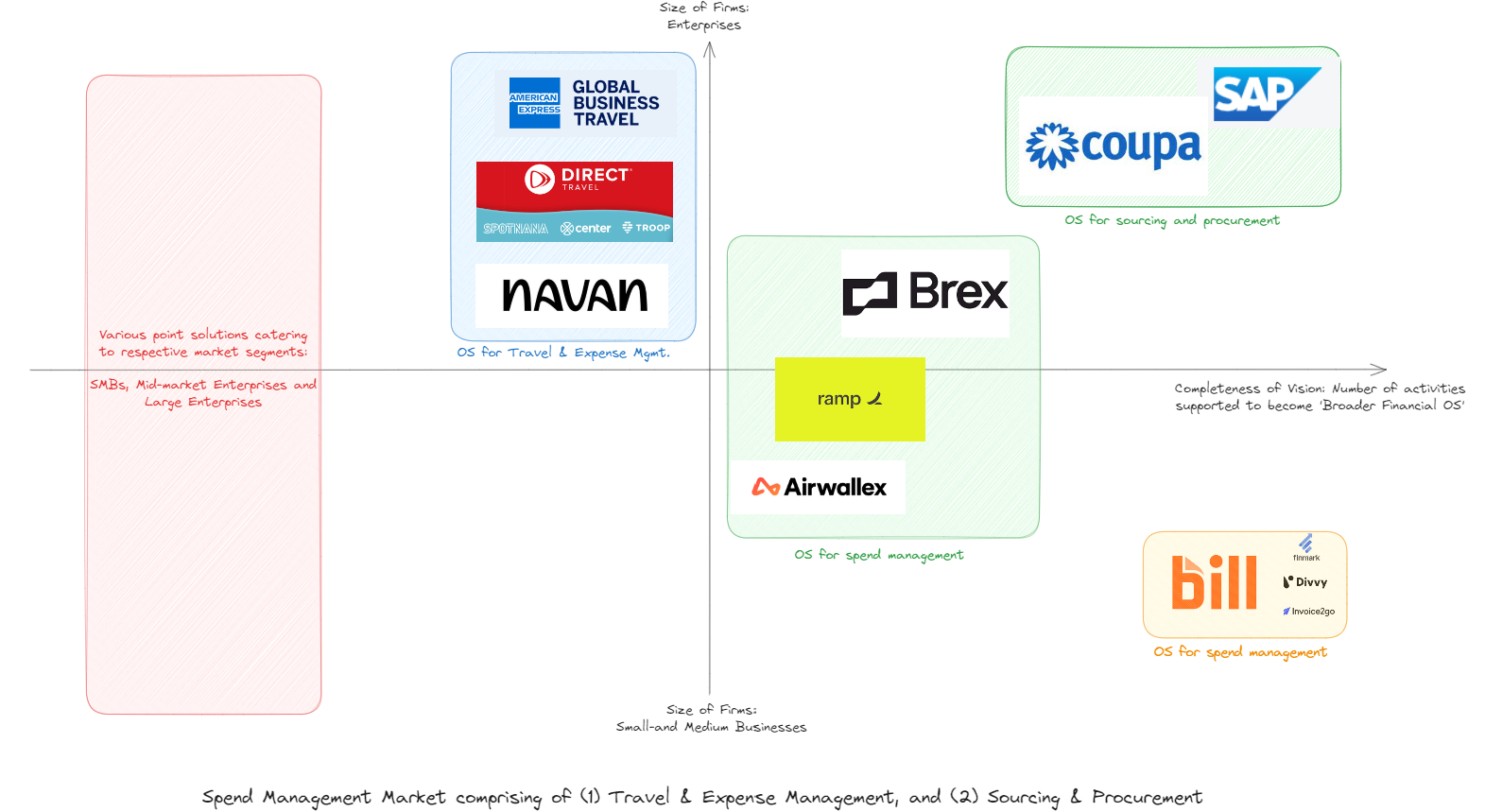

Before diving into trends and speculating about the future, let’s segment this market to locate where the major players are currently positioned. To understand this industry I map the key players along two dimensions - (1) Size of target customers and (2) Completeness of ‘Financial OS’ vision This is because both these dimensions impact customer preferences when it comes to the choice of vendor for their finance tech stack.

From a size perspective, the spend management industry could be divided into 3 segments depending on the size of the target customers viz. Large Enterprises (Coupa, Amex GBT), Mid-market Enterprises (Brex, Ramp) and SMBs (BILL, QuickBooks). As we go down-market, we notice there’s a trend of customers preferring transaction-based pricing as smaller businesses cannot justify paying high subscription fees. On the other hand, as we go up market, we notice customers prefer subscription-based pricing as transaction-based pricing starts to get too costly with high transaction volumes. Likewise, as we go upmarket, the complexity of use cases starts to increase and tech providers have to deal with lot of other vendors in the customer’s tech stack. In general though, the market for enterprises is much bigger and we don’t see a lot of players catering to the needs of SMBs.

From a completeness perspective, the more solutions a customer can access from a single vendor, the less overhead they face from managing multiple vendors. This value proposition appeals strongly to smaller customers who benefit from the simplicity of a one-stop shop. As these customers grow and their needs become more complex, they often shift to multi-vendor solutions. For larger enterprises, the search for “single vendor” evolves into a search for an “ecosystem player,” where the primary vendor doesn’t necessarily provide all products in-house but offers seamless integrations with other vendors of the customer’s choice. For instance, Brex might pitch itself as a “vertically integrated” or “Financial OS” solution for mid-market enterprises and fast-growing startups. However, for larger enterprises, it emphasizes being a “single vendor with a comprehensive suite of integrations.” Building these partnerships and establishing a preferred vendor status can take time, and what qualifies as “complete” for the mid-market may not meet the standards of a large enterprise.

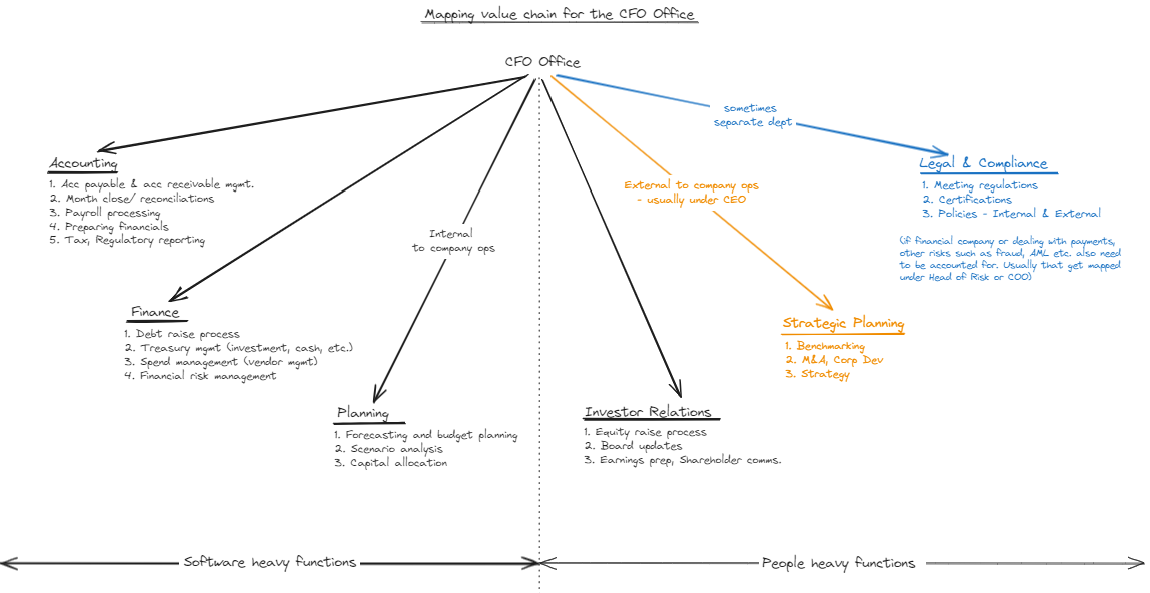

To evaluate the completeness aspect, therefore, I mapped out the range of functions and activities typically handled by a CFO Office. While I’ve focused on the primary ones, the activities used to determine completeness aren’t exhaustive (see appendix for details). Additionally, as discussed, the scope of “Financial OS” can be broad or narrow depending on the target customer. For market segmentation here, I’ve chosen a “Broader Financial OS” definition to assess completeness and have focused on companies that have shown substantial growth within the spend management category.

Industry Evolution

Broadly, the industry seems to be going through a confluence of trends that’s resulting in changing the industry structure. Here I try to identify the three main ones that are likely to have a material impact on how the industry evolves:

-

Vertical integration to combat SaaS sprawl - In today’s SaaS landscape, enterprises— even the largest ones— are overwhelmed by the sheer number of available vendors. In fact, there is now a separate market for SaaS Management Platforms! The SaaS sprawl has created a premium for single-vendor solutions or, at the very least, a strong preference for minimizing vendor relationships (source). A clear example of this trend can be seen in the rapid rise of companies like Brex and Ramp. These companies began by offering corporate cards and built a robust competitive edge by eliminating interchange fees in exchange for software usage. Similar to how Square developed an ecosystem around its POS systems, Brex and Ramp now offer a comprehensive suite of financial tools around their corporate cards, allowing businesses to streamline multiple vendor needs into a single, integrated platform.

-

Secular adoption of AI/ML technologies - Firstly, the fear of being left behind by not adapting to AI is looming large on every corporate leader’s mind. Incumbents are aware that if they don’t modernize now and harness what AI has to offer, it will only be a matter of time before they get disrupted by those who do. This is resulting in AI-related investments by enterprises to explore how proprietary data and customer relationships can be used to strengthen their current market positions. Secondly, there is a growing threat from emerging interfaces powered by Generative AI, which could reshape customer relationships. These AI-powered platforms and “wrapper” software solutions can bypass traditional customer touchpoints that enterprises have relied on, potentially leading to their disintermediation.

-

Travel going through its personalization wave - Travel is an important sub-category under Spend Management. We see value chain related to the travel and meetings use cases going through substantial changes as the travel industry adapts to NDC. For context, NDC or New Distribution Capability is an XML-based data transmission standard to let airlines bring rich content and ancillaries directly to online travel agencies (OTAs), travel management companies (TMCs), and other flight resellers through a set of travel APIs. It enables travel service providers to personalize their offering by having detailed data on their customers. If you’re curious you can learn more about NDC here. Adoption of this new technology is forcing industry players to reinvent themselves.

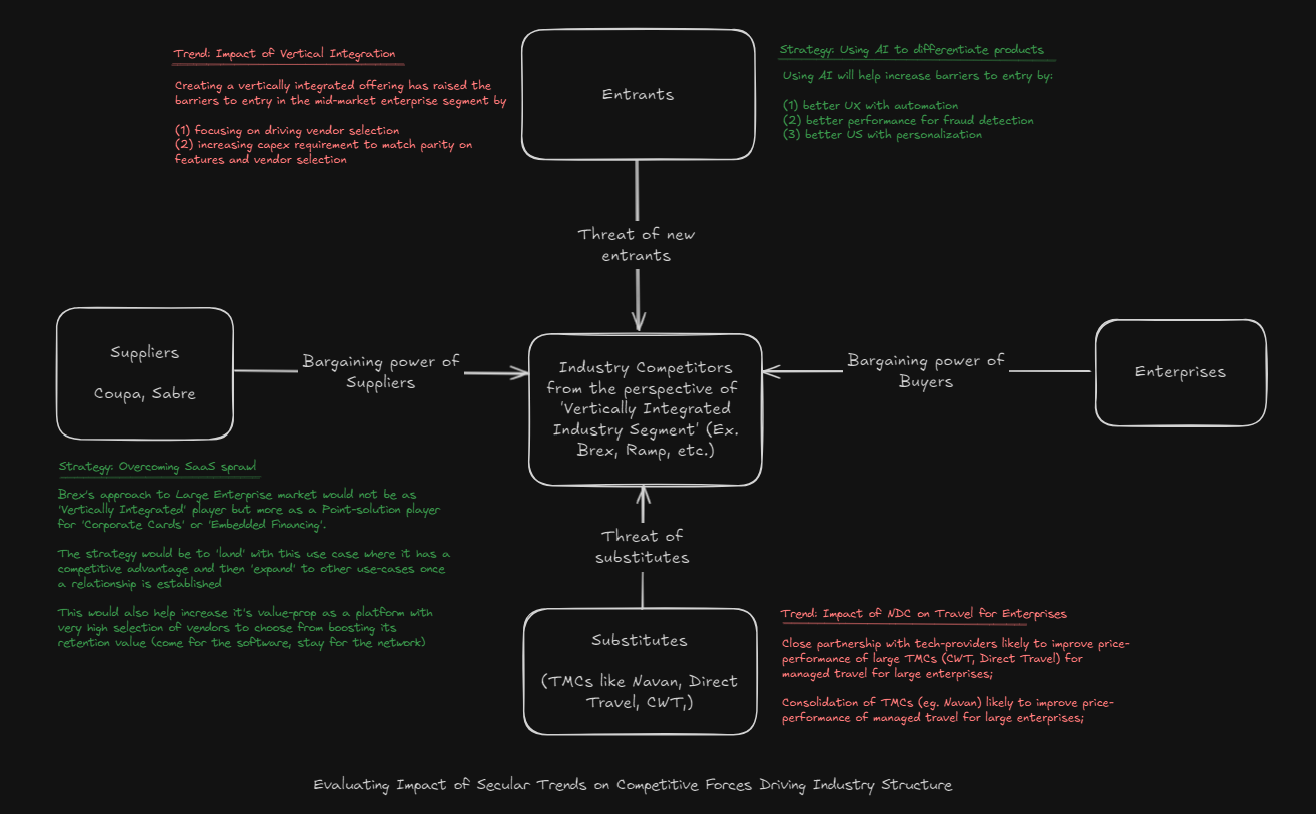

Together, these trends are shifting tha balance of competitive forces and reshaping the industry’s structure. Since we aim to learn from these changes as early-stage founders building vertical software, we analyze them through the lens of companies like Brex and Ramp— i.e., through the lens of the industry segment that has adopted a vertically integrated strategy.

Broadly, we can anticipate the trends to manifest in the following three ways:

-

Incumbents will adapt to defend their market share - After consolidating their position in the mid-market segment, the likes of Brex, Ramp, etc. are strategically going upmarket. While direct competition with the likes of SAP Ariba, Coupa, etc. seem unlikely at this stage, incumbents that cater to large enterprises are preparing to defend their market positions. This is showing up in a more prevalent manner at large Travel Management Companies (TMCs) as the lines between TMCs and tech providers are increasingly getting blurred. TMCs are grappling with secular changes at multiple fronts viz. the adoption of NDC, rising cost of debt, and moderninzation of travel offerings from tech providers. This confluence of factors has led to a race of sorts among large TMCs to grab or defend their market-share, necessitating influx of fresh capital. We can infer this from the amount of private equity that has gone into these TMCs to fix their capital structure and adapt to the technological trends shaping the industry landscape. Specifically, this has taken the form of TMCs like CWT, Direct Travel, etc. building formal/semi-formal alliances with tech providers to defend their large enterprise relationships. Similarly, companies like Navan have acquired a host of smaller TMCs to augment their scale of offerings and benfit from economies of scale.

-

Planning-related use cases will be a key differentiator - As incumbents lean on to their strengths to defend their positions, vertically integrated companies need to find strategies that internally fit with their strengths. In the world of spend management where there is increasingly a lot of parity in product features, that would mean optimizing for certain niches in the market. This brings us back to the white-lint-on-a-black-dress moment when Thoma Bravo had taken both Coupa and Anaplan private in 2022. I think planning is one of those use cases that doesn’t generalize across domains and is a natural extension to spend management. For example, supply chain planning would be different than travel related planning which in turn would be different than workforce planning and so on. I therefore think planning has the potential to truly become a differentiator for the vertically integrated spend management companies. We see some evidence of this already at play where spend management companies have acquired or made alliances with planning software providers. For example, Coupa had acquired LlamaSoft to improve its supply chain offering, Brex acquired Pry and Direct Travel is working closely with TROOP for meetings and events planning. Furthermore, as global supply chains are reorganized due to geopolitical factors, spend management firms have an opportunity to create differentiated offerings in supply chain planning for both procurement and operations.

-

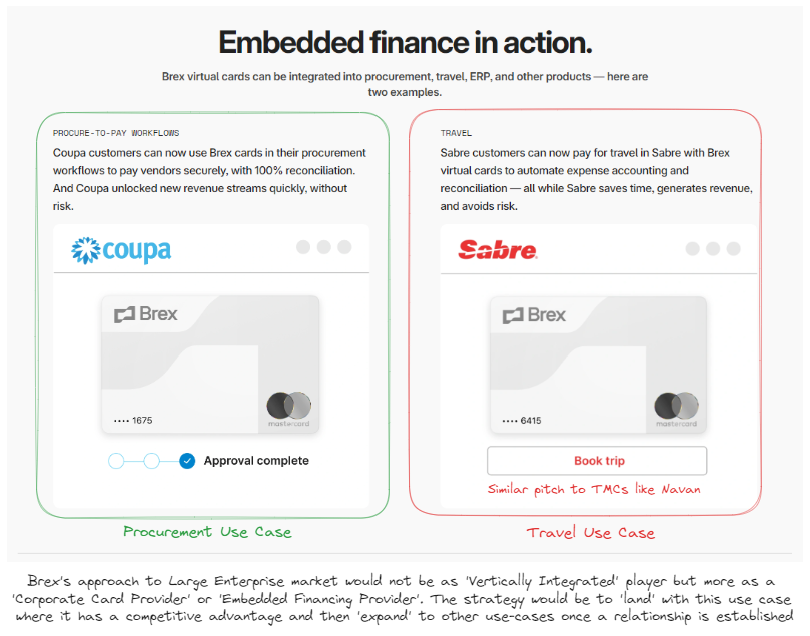

“Come for the service, Stay for the network” will be a key growth strategy - Increasingly, we find there is parity in product features offered by various spend management tech providers. As a result what will ultimately differentiate is the network of 3rd party vendors, accountants, B2B software companies etc. that use these products. Having a wide selection of vendors also enables these tech providers to help their customers fight the SaaS sprawl. The need to enable a wide selection of vendors on the platform is, therefore, leading to situations where a company like Brex is promoting use of its corpoarte cards on competing solution providers like Navan and Coupa. It may seem odd at first but it helps to remember that Brex is a vertically integrated solution for mid-market enterprises. But, its pitch to large enterprises is more of being a point solution provider for corporate cards or embedded financing. This strategy to ‘land’ with the corporate card use case where it has competitive advantages, and then expand to other use cases once relationship is established thereby helps Brex increase its network of 3rd party vendors.

Takeaways for Early-Stage Startups

The ZIRP era (2010–2020) likely led to the creation of numerous “red oceans” in various SaaS categories— MarTech, CFO Stack, Risk Monitoring, and Fraud Detection Solutions, among others. This SaaS sprawl has heightened the need among decision-makers for streamlined solutions, such as a unified dashboard or a single API (especially in risk solutions) that aggregates multiple data sources. Such consolidation would enable faster, more informed decisions and empower businesses to adapt to rapidly changing industry environments.

This current need, I think, lends itself well to the creation of vertical software since it requires a high degree of customization. Verticalization also opens up the possibility to flatten the value chain by combining previously separate functions to better realize the gains from AI-driven efficiencies. Therefore, for early-stage founders who are building currently at the intersection of AI and SaaS, I think it will bode well to deeply embed themselves in niches where high frequency problems or workflows have not yet been touched due to perceived lack of value. Much like what Square did with POS machines and what Brex did with corporate cards, founders will have to go to the source of problems and rethink the value chain from there.

In closing, I think what we are seeing in the spend management industry could very well be a story that repeats in a lot of other SaaS categories as the industry adjusts to AI-driven disruption. It’s a classic David vs. Goliath scenario: nimble AI-first startups that manage to create and grow some kind of vertical software ultimately have a face off with incumbents who lean into their strengths i.e. leverage existing customer relationships and data to differentiate their offerings. What will differentiate the startups that ultimately survive and win in the long term is whether they would have managed to build a sustainable competitive advantage - whether by having the lowest cost structure or by creating a sustainable differentiated offering that equips them to fight the competitive forces in their industry.

Appendix